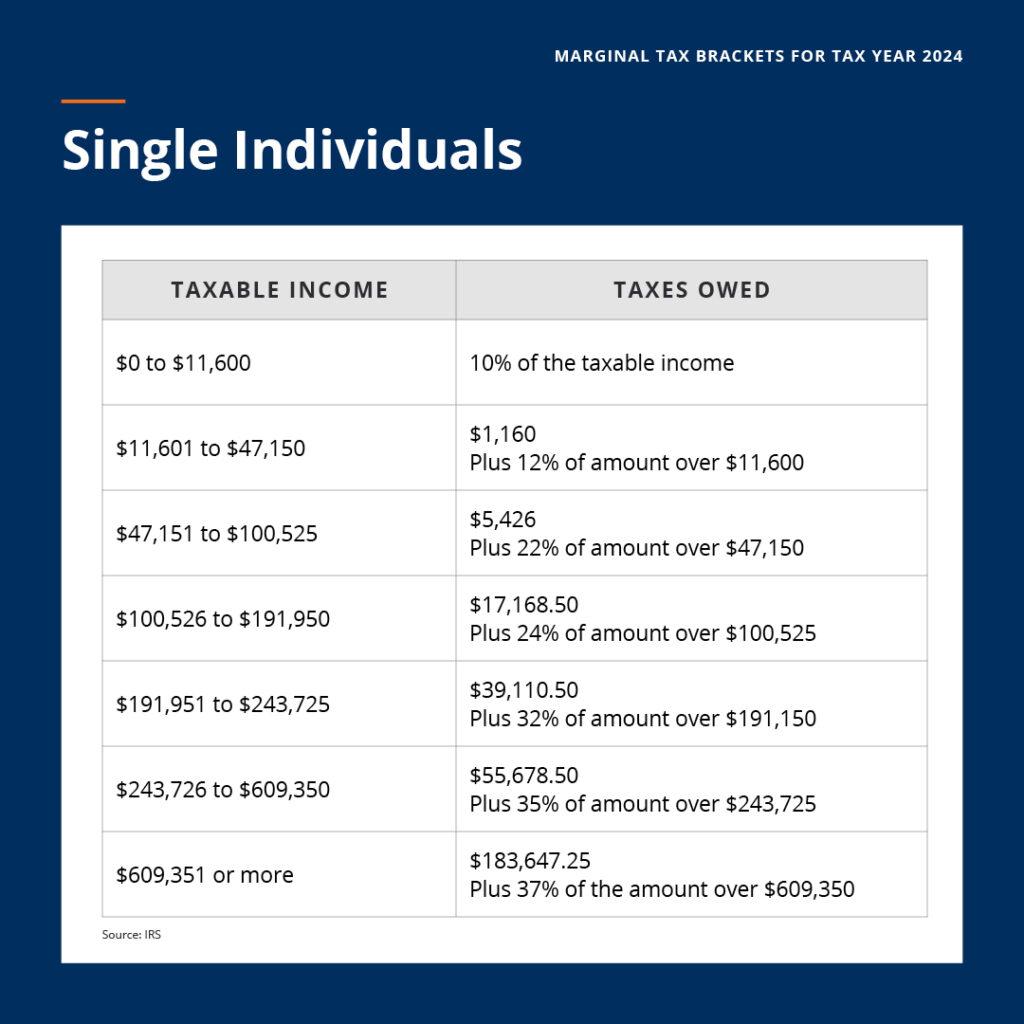

2025 Tax Brackets Singles. Here's what you need to know. 10%, 12%, 22%, 24%, 32%, 35%, and 37%.

In 2025, the top tax rate of 37% applies to those earning over $609,350 for individual single filers, up from $578,125 last year. Your bracket depends on your taxable income and filing status.

2025 Married Filing Jointly Tax Brackets Single Casi Martie, In 2025, the top tax rate of 37% applies to those earning over $609,350 for individual single filers, up from $578,125 last year.

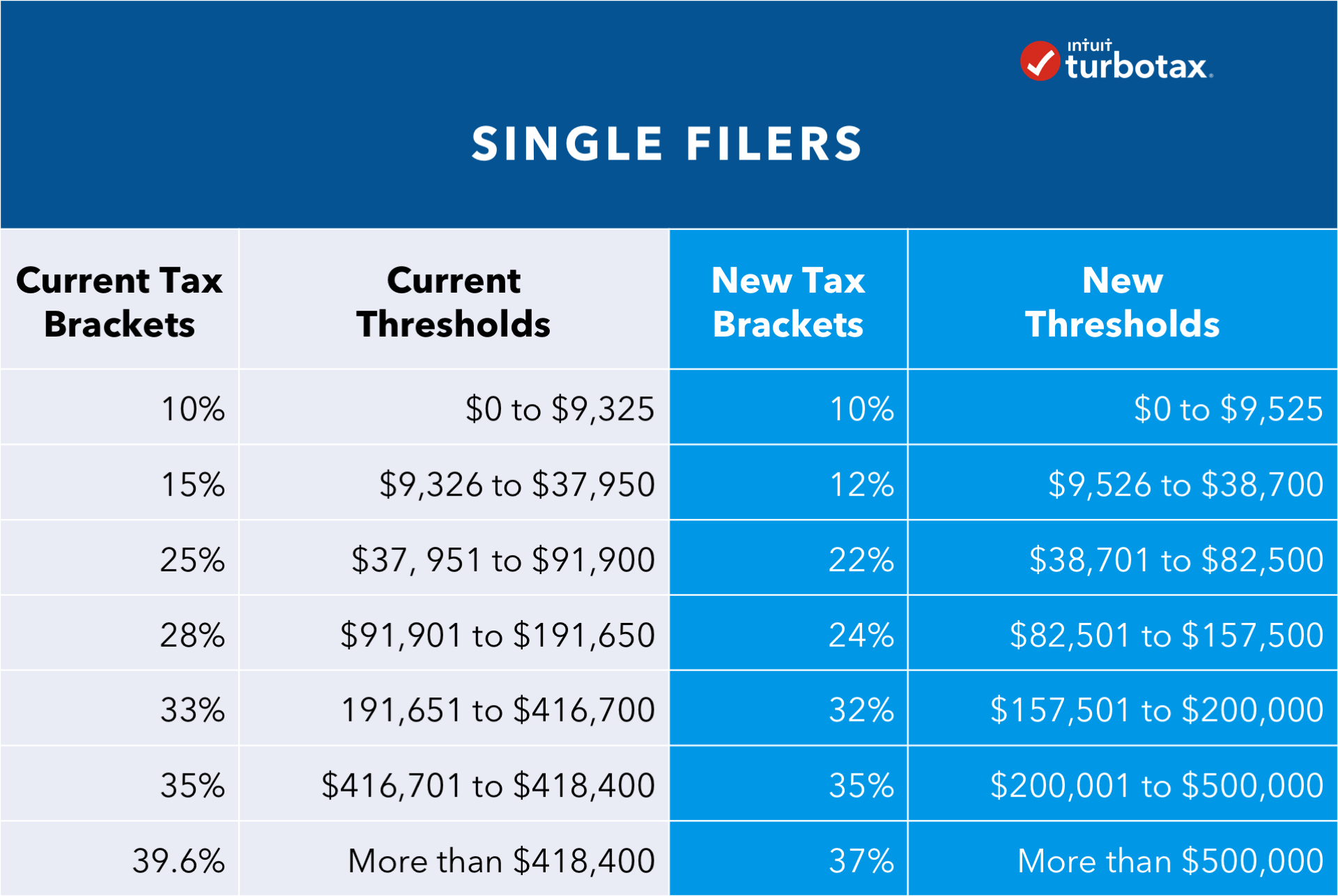

2025 Vs 2025 Tax Brackets Single Elle Elfreda, The irs has adjusted federal income tax bracket ranges for the 2025 tax year to account for inflation.

2025 Tax Brackets And Standard Deduction Table Cate Marysa, Irs releases income tax brackets for 2025.

Single Filer Tax Brackets 2025 Twila Martita, 10%, 12%, 22%, 24%, 32%, 35% and 37% (there is also a zero rate).

Federal Tax Brackets 2025 Single Mela Stormi, Operates on a progressive tax system , meaning that.

2025 Tax Brackets Announced What’s Different?, The agency also announced other changes that include a new standard deduction and a higher limit for flexible spending accounts.

Tax Brackets 2025 Single Person Reeva Celestyn, The seven federal income tax brackets for 2025 are 10%, 12%, 22%, 24%, 32%, 35% and 37%.

Tax Rates 2025 Single Filer Heda Rachel, The internal revenue service (irs) uses tax brackets to determine the income tax you owe.